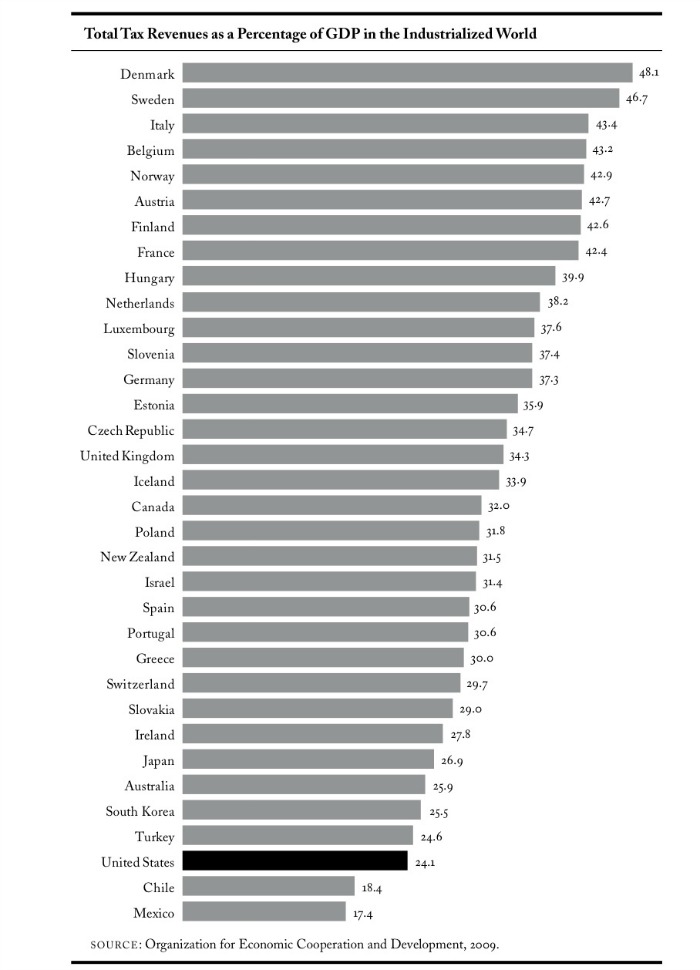

Here’s an interesting graphic from the Foreign Affairs website (sponsored by the Council on Foreign Relations). It puts America’s level of taxes in a world perspective. There are some “But it doesn’t take into account…” kinds of objections, but still.

A lengthy articles, titled “America the Undertaxed: U.S. Fiscal Policy in Perspective,” accompanied the graphic. A few tidbits from the article.

- We’ve heard that the US has the highest corporate tax rates in the developed world. The article confirms that, at a 39% rate. But with all the tax breaks and credits and other bookkeeping tricks we allow, the effective rate is an average of 13%, the lowest among the G-7 countries.

- The amount of total US income going to the top 1% of earners increased from 9% in 1970 to 23.5% in 2007. They earn 20% of all income, but hold over 30% of all wealth. The next highest is Germany, where the top 1% earn just 11% of the country’s total income. So the disparity is severe in the US, and prosperity which once went to the middle class now goes to the very rich.

- The article deals at length with income inequality and the things we’ve built into the tax code to specifically benefit the rich. The article says we have the highest poverty rate among rich nations.

- According to Paul Ryan’s budget plan, 62% of the spending reductions would affect low-income households (government programs being cut), and low-income households would also face higher federal taxes because of a reduction in the Earned Income Tax Credit.

- Meanwhile, persons earning over $1 million would get a tax cut of $265,000, on top of the Bush tax cuts already in place. This from the Center on Budget and Policy Priorities.

1 Comment to "American Taxes Vs. the World"